1. Introduction - Cashew in Maharastra

The National Bank for Agriculture and Rural Development (NABARD), German Development Bank (KfW) and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH are collectively implementing the Umbrella Programme for Natural Resource Management (UPNRM), the aim of which is to promote environmentally sustainable growth by encouraging private investments that are pro-poor. This represents a paradigm shift as the programme moves away from purely grant-based funding to a greater reliance on loans. This increases the leverage and outreach of investments in rural areas, creating income based on sound business models that ensure the sustainability of natural resources.

Under UPNRM, a project was sanctioned to Lupin Foundation in February 2015 to provide working capital assistance in the form of a revolving fund for assisting small-scale cashew entrepreneurs in the cashew belt of Sindhudurg district. The project intended to enhance their scale of operation and increase household income.

The implementation agency of the project is Lupin Human Welfare Research Foundation (LHWRF) herewith referred as Lupin Foundation in the report. The Lupin Foundation established a centre in the Sindhudurg district 17 years ago and began its operations in Maharashtra. The centre is engaged in the holistic development of the villages under its wing. The centre has developed a model of sustainable dairy development under UPNRM project funded by NABARD.

Based on the successful implementation of the first phase of project under UPNRM, second phase of the project was sanctioned to Lupin Foundation. The project was titled - Strengthening Small Cashew Processing Units through financial support and Capacity Building Programme.

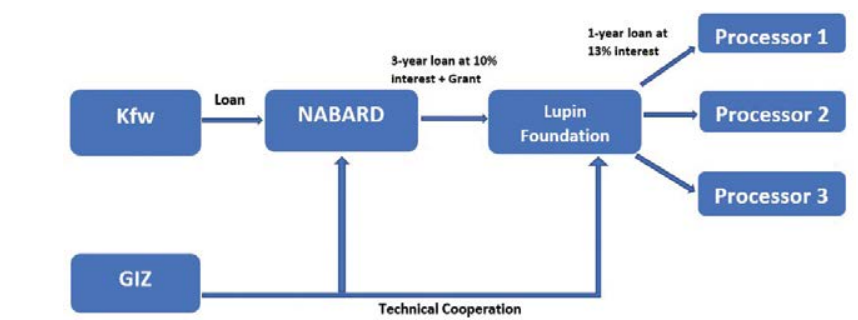

Under UPNRM, KfW provided a grant to NABARD which in turn disbursed loans to Lupin Foundation at 10% rate of interest. Then Lupin foundation in turn disbursed loans to their member farmers at 13% rate of interest. Loan is sanctioned with a lot of flexibility in terms of the repayment duration. The borrowers have to pay interest only for the balance principal amount after repayment. Lupin pays the processors the loans in cheque transaction. This loan-based model was selected over the pure grant-based model to create a revolving fund which could result in maximum developmental impact from a limited fund amount. Also, such development aid generally supports local entrepreneurs thus increasing long-term incomes of the community in a sustainable way.

|

Date of sanction |

Project period |

Loan amount sanctioned (in Rs Lakh) |

Loan amount utilization (in Rs Lakh) |

Grant amount sanctioned (in Rs Lakh) |

Grant amount utilization (in Rs Lakh) |

|

13 Feb 2015 |

3 years |

75 |

75 |

11.16 |

11.16 |

As part of UPNRM, LHWRF we supported the farmers by – providing finance, plantation material form nursery, training & capacity building, mobile connection integrated, RM procurement and processing support. Total beneficiaries under the UPNRM project with channel partner Lupin LHRWF were 53 small-scale processors. They were given training of cashew specific processes and machines. NABARD had provided a loan to LHRWF of 75 lakhs for 3 years. LHWRF utilized 66 lakhs to disburse loans to 53 beneficiaries. The rest of the Rs.9 lakh amount was used to procure planting material, capacity building and administrative cost. LHWRF has provided beneficiaries with 3 cycles of loans. Each loan had a principal amount of 1.25 lakh with 13% interest rate per annum. Out of these around 10% borrower have defaulted on loan repayment.

The project has supported around 100 small-scale cashew entrepreneurs who have been extended financial assistance for procurement of raw cashew and handholding support to enhance their technical capacity and increase scale of processing of cashew, and in the process enhance their living standards. The project has helped reduce dependency on middlemen for credit purchase of raw material and timely financial support has helped entrepreneurs procure quality raw material on time. Grant support and CSR convergence has also been integrated for planation of 10,000 new cashew trees in around 100 acres of land.

The implementation arrangement of UPNRM grant with Lupin as channel is given below.

The project has had considerable social impact. The average processing by entrepreneurs was around 60 kgs per day in the pre-intervention period which has now been raised to average 125-150 kgs per day due to enhanced availability of quality raw material. This has led to commensurate increase in income of cashew entrepreneurs. The plantation of around 10,000 new cashew nut plants is also to be taken up. Based on successful credit history generated for these cash entrepreneurs, Lupin Foundation aims to help these small cashew entrepreneurs link to commercial banks for further channelization of working capital assistance.

Cashew has the potential to increase the incomes of poor farmers, create employment opportunities, and increase exports. However, like other small-scale processing operations, cashew processing comes with its own risks and challenges: inconsistent supply and quality of raw material, access to finance, poor market linkages, etc. These constraints are not, however, insurmountable, and with committed support from local governments and development organizations, cashew processing can become an attractive and viable option for the small-scale enterprises

2. Profitability - Cashew in Maharastra

In our model an average small-scale processor sold processed and semi-processed cashews to brokers and made sales worth approx. 16 lakhs annually. The sale included a mix of consumable cashews, cashew kernels, and by-products. The processing unit had to bear majority of expenditure from procuring RCN approx. 7250 kg at a total cost of approx. 11 lakhs. The labour cost and overheads amounted to approx. 1 lakh. Thus, the process was able to earn a profit of approx. 4 lakhs and achieve a profit of 33% over total costs.

|

Financial Summary |

|

|

Total Revenue |

15,92,789 |

|

RCN Procurement Cost |

10,87,500 |

|

Overheads & Labour |

1,12,280 |

|

Net Profit |

3,93,009 |

|

Profit % on Costs |

33% |

This reflects that the small-scale cashew processing industry has immense potential in the area and could produce profitable and sustainable enterprises. With adequate regulatory support and financing options the industry could get an access to the working capital that it requires to procure the locally produce RCN and add value through the processing units in the district itself.

PROFIT AND LOSS (P&L) STATEMENT

The P&L statement for the model processing unit is given below. It describes the revenue and cost headers in more details. The RM cost is calculated by average buying price and the average RCN qty procured. The direct revenue from processed cashew sales is found by average selling price and the processed cashew qty. Here the conversion rate from RCN to Cashew Kernel is assumed as 30%. After considering the weight loss from peeling and broken (scorched, butts, splits) this conversion rate comes down to 24%. Alternate income can be derived from selling the shells, kernels, and cashew splits. The overheads include cost of electricity, wood, transportation fuel, and packing material. It also includes the labour salaries in rate/kg. Generally, this model units employ family labour or some workers on need basis. Finally, the profit is calculated after subtracting total costs (overheads, labour, and RCN procurement) from total revenue (direct revenue, and alternate income).

|

Small-Scale Processing Unit, Sindhudurg |

||

|

RM cost |

RCN procured (kg) |

7,250 |

|

RM after drying loss 5% (kg) |

6,888 |

|

|

Buying Rate (Rs/kg) |

150 |

|

|

Total |

10,87,500 |

|

|

Revenue |

Cashew Kernel - without shell (kg) |

2,175 |

|

Peeling Kernel skin loss 10% (kg) |

218 |

|

|

Broken cashew loss 10% (kg) |

218 |

|

|

Processed Cashew (kg) |

1,740 |

|

|

Selling Rate (Rs/kg) |

800 |

|

|

Total |

13,92,000 |

|

|

Alternate Income |

Kernel skin (Rs 18/kg) |

3,915 |

|

Cashew shell (Rs 7/kg) |

33,749 |

|

|

Broken cashew (Rs 750/kg) |

1,63,125 |

|

|

Total |

2,00,789 |

|

|

Gross Profit |

5,05,289 |

|

|

Overheads |

Drying labour (Rs 1/kg) |

7,250 |

|

Shell removal labour (Rs 12/kg) |

26,100 |

|

|

Peeling kernel labour (Rs 12/kg) |

20,880 |

|

|

Grading labour (Rs 5/kg) |

8,700 |

|

|

Electricity Cost (Rs) |

12,837 |

|

|

Wood Cost (Rs) |

7,591 |

|

|

Transport (Rs) |

18,089 |

|

|

Packing (Rs 10/kg) |

10,832 |

|

|

Total |

1,12,280 |

|

|

Net Profit |

3,93,009 |

|

|

Monthly income |

32,751 |

|

|

Profit on Revenue |

25% |

|

3. Cost Economics - Cashew in Maharastra

Income Projections

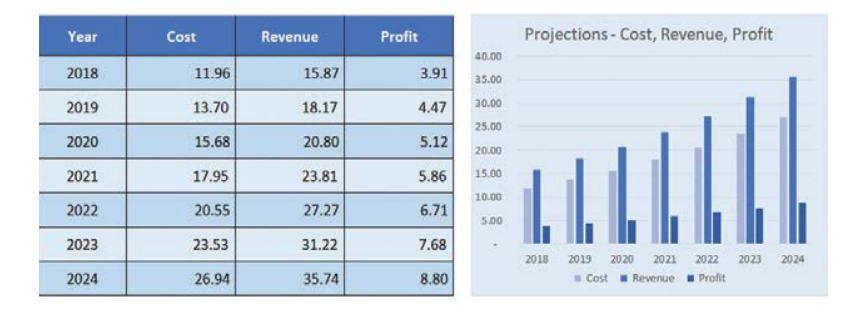

In this section some projections about the revenue, cost and profit of the model unit are going to be made on the basis of few assumptions. The semi-mechanised model processing unit, under-utilises its present capacity as it is unable to procure enough RCN (Raw Cashew Nut) due to lack of working capital. Therefore, there is still significant potential to operate at higher scale without any additional need to increase processing capacity. Thus, capital costs at12.19 lakhs can be assumed to remain constant for the next 7 years projection

As per the primary data collected, most of the processors reinvested approx. 30% of their yearly earnings and kept the other 70% for savings and personal expenses. The processor used the majority of the reinvestment to procure 7% more RCN qty next year. It is assumed that the processor made no changes to other existing financing options such as trader credit, LHWRF loan, commercial loan, etc. So, the 7250 kg of RCN qty procured in 2018 increases to 7757 kg next year. The price of RCN also increases each year by 4.5%, which is derived from the WPI inflation averaged over 10 years. This is in line with the 4.5% CAGR growth of the cashew industry. This 4.5% is an assumption as there is no available RCN price trends because of the unpredictable nature of the seasonal cashew industry.

Similarly, the selling price of processed cashew increases at a rate of 4.5%, which is derived from the averaged WPI inflation rate and the industry CAGR growth rate. The processed qty is derived from the RCN procured qty by using the industry defined 24% conversion rate. After determining the processed qty and the selling price the total revenues can be calculated by keeping the weightage of other cost and revenue variables as same.

The net income can be derived by subtracting total costs from total revenue. It reflects a healthy growth rate of 14% despite other financing options being constant. If the project mainstreams the working capital requirement through commercial banking, then this growth rate can easily exceed the derived 14% value.

Internal Return Rate (IRR)

Internal Return Rate is the rate of growth a project is expected to generate. While the actual rate of return that a given project ends up generating will often differ from its estimated IRR, a project with a substantially higher IRR value than other available options would still provide a much better chance of strong growth.

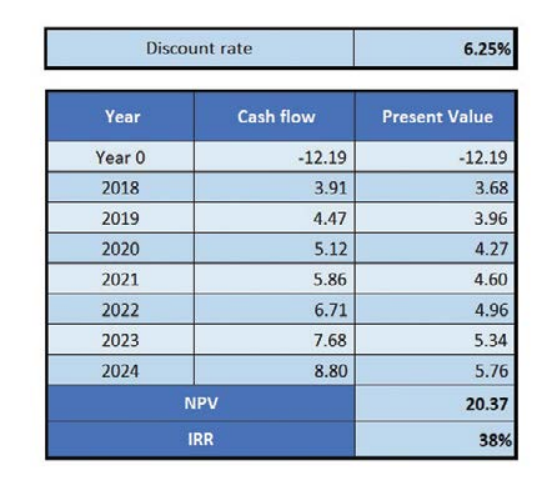

While calculating IRR and NPV, the capital cost is taken for year 0. From 2018 cash inflow (profits) are considered from above projections.

IRR is calculated using the cash inflow (profits). In the small-scale processing model, the Internal Rate of Return (IRR) of 38% reflects the financial viability of the model. Similarly, Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

A positive net present value indicates that the projected earnings generated by a project or investment exceeds the anticipated costs. The present value is calculated for each year by considering the RBI defined discount rate of 6.25%, resulting in a very healthy NPV (Net Present Value) of 20.37 lakh.

With an IRR of 38% and NPV of 20.87 lakhs the Lupin Foundation model is a viable option for commercial bank lending.

Benefit Cost Ratio (BCR)

Benefit Cost Ratio (B/C ratio) or Cost Benefit Ratio is another financial ratio which is considered for evaluating a project investment. This is an indicator used in cost-benefit analysis to show the relationship between the relative costs and benefits of a proposed project, expressed in monetary or qualitative terms.

The BCR must be used as a tool in conjunction with other types of analysis to make a well-informed decision.

|

BCR VALUE |

INDICATION |

|

GREATER THAN 1 |

THE PROJECT’S BENEFITS OUTWEIGH THE COSTS AND SHOULD BE CONSIDERED |

|

LESS THAN 1 |

THE PROJECT’S COSTS OUTWEIGH THE BENEFITS AND SHOULD NOT BE CONSIDERED |

The BCR of a project is calculated by dividing the proposed total cash benefits (present value of net positive cash flow) by the proposed total cash costs (present value of net negative cash flow) at the mentioned discount rate.

Benefit Cost Ratio (BCR) = PV of Net Positive Cash Flow/PV of Net Negative Cash Flow BCR =32.57/12.19

BCR = 2.67

The value of BCR is greater than 1 and indicates that the model will deliver a positive net present value to the investors (banks, firms, etc) making it a profitable investment opportunity.

Payback Period

Payback period is the time required to recover the cost of an investment. It is the number of years it would take to get back the initial investment made for a project.

It is a simple way to evaluate the risk associated with a proposed project. The desirability of an investment is directly related to its payback period. Shorter paybacks mean more attractive investments. Calculation of payback period is done below.

A= Last period of negative cash flow (number of years before full recovery) B= Unrecovered cost at start of the year

C= Cash flow during the year

|

Year |

Expected Cash flow |

Remaining cash needed to cover initial investment |

|

2018 |

3.91 |

8.28 |

|

2019 (A) |

4.74 |

3.81 (B) |

|

2020 |

5.12 (C) |

Not Required |

The payback period is 2.7 years which indicates that the initial capital cost of 12.19 lakhs will be recovered in 2 years and 9 months approximately. This short payback period of the model makes it an attractive opportunity for commercial bank lending as the time required to recover the cost of an investment is quite short.

Breakeven analysis

Break-even point analysis calculates the margin of safety by comparing the amount of revenues or units that must be sold to cover the fixed and variable costs associated with making the sales. In other words, it’s a way to calculate when a project will be profitable by equating its total revenues with its total expenses.

Fixed cost: Rs.12,19,000

Sales Price of 1kg processed cashew nut: Rs.800 (processor) Total number of processed cashew nut(kg): 1740

Sales Price of 1kg broken cashew nut: Rs 750 Total number of broken cashew nut(kg): 218

Variable cost of 1kg processed cashew nut: Rs.165 (variable cost of labour, overheads and procurement of 7250 kg RCN is Rs. 11, 96, 250).

Variable cost of 1 kg broken cashew nut: Rs 165 (variable cost of labour, overheads and procurement of 7250 kg RCN is Rs. 11, 96, 250).

Cashew by products- cashew shells and Kernel skins are not considered in the calculation as the total contribution of both these products is very low as compared to processed and broken cashews.

|

|

Processed cashew |

Broken cashew |

Total |

|

Sales amount |

1392000 |

163500 |

1555500 |

|

Total variable cost |

287100 |

35970 |

323070 |

|

Contribution margin (sales amount- total variable cost) |

1104900 |

127530 |

1232430 |

We use the data in the “Total column” to compute the break-even point. The contribution margin ratio is 79.23% (Total contribution margin (Rs 12,32,430)/Total sales Rs (15,55,500)). Assuming the product mix remains constant and fixed cost for the company is Rs 12,19,000.

Break-even point in Rupees = Fixed Capital Cost/Contribution Margin Ratio

= 12,19,000/.7923

=15,38,558

So, the processor needs to generate Rs 15,38,558 to reach the break-even point through sales of cashew nut (processed and broken).

The weighted selling price of processed and broken cashew nuts. Weighted selling price: 800*.882 + 750*.118 = 705.6 + 88.5= 794.1

Number of cashews (in Kg): Breakeven point/ Weighted selling price

= 1538558/794.1 = 1937.48

The processor needs to sell a total of 1937 Kgs of cashew nuts in order to reach the breakeven point.

The difference between breakeven value and the fixed capital costs is small, which is a positive indicator in terms of financial viability of the model that will make it more suited for commercial bank lending.

Chapters

Download the detailed resource material to help understand the better functioning and best practices for FPO.